Ask anyone outside of Finance what they want from Finance, and they will say “Insights”

Ask them what do you mean and they’ll say “I don’t know you work it out”

So today I am going to help you not only deliver Insights but improve your chances to get those insights actioned.

In our workshops we work methodically through defining data, insights and action

Most finance professionals think data produces insights which they deliver to non finance with recommendations – and then they go and action it.

Seems quite logical and fair.

Except it doesn’t work like that.

Most non finance audiences will rebut what you have found, maintain their own agenda and status quo and tell you “yeah but you haven’t considered this”

If you have ever provided a recommendation nobody has done you will know what I am talking about

The reality is, it’s way, way, easier than that.

And at theFBPteam we are big on process and tools to help you do it.

To help demonstrate it there are two very important frameworks and concepts to understand

The first is the What (and why), So What, Now What frameup.

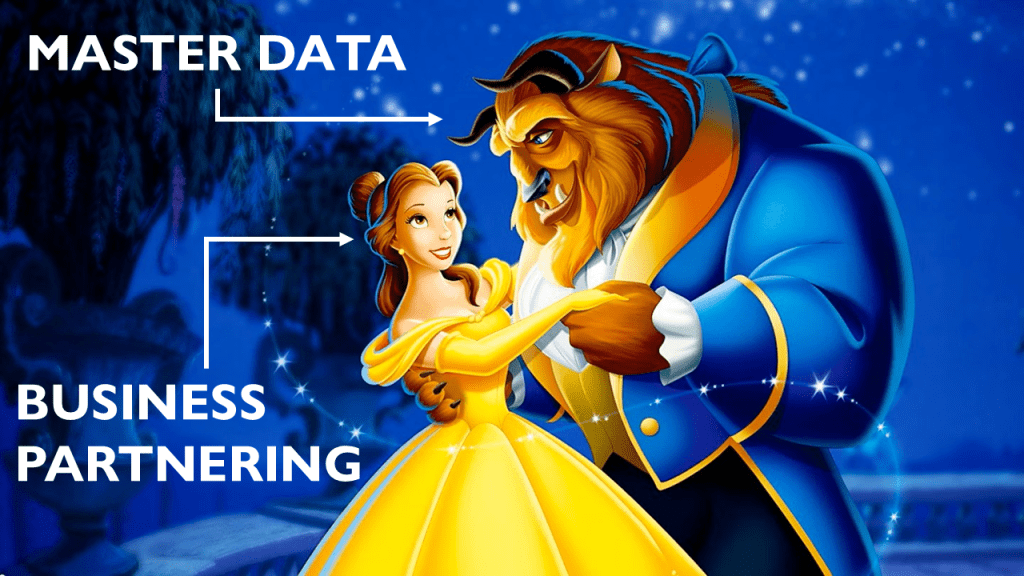

Data is the What (and why) – its predominantly backward looking and explains to your audience what has happened, and why it has happened.

It’s pretty easy and in this day and age should be fairly quick if you have “clean data” – AI can do it all, seriously.

The key factor with Data and the What (and why) is that it can be done from your desk.

This is the second key concept. The “What (and why)” can be done from your desk – whereas the Insights and the Action is “away from your desk”

If it’s from your desk you don’t need to talk to anyone. You could happily lock yourself away in a dark room, dig down into your ERPs and dashboards and spreadsheets and very productively and accurately deliver the what and the why

But it’s usually only at a surface level.

Which is why it is perfect for the robots to do.

Insights on the other hand is the “so what”

What does this mean for us, what are the consequences of knowing this, and most importantly what can we do about it.

This is where most finance professionals fall over. They don’t actively engage their stakeholders on this part of the process and try to deliver insights to them all ready and in a state to be actioned.

You do it “from your desk” rather than “away from your desk”

Insights and the “so what” can only be obtained through discussion and accordingly is done “away from your desk”.

Whereas data and the what (and why) is done from your desk. Insights has to be done away from your desk in consultation with others.

You take the data (the what/why) you discuss it for context and understanding and then you start to explore things you want to do because of it.

Away from your desk with the other functions.

It has to be done with other people, and for a finance person your role in this place is not to tell people your insights and make recommendations. It is to ask questions and explore.

We call them future focused questions

Questions about the future to open people up and thinking consideration about what could happen

Once that is explored you then move into the space of Action, or the Now What?

This is where you shift the discussion from what could be done and exploration – to a discussion on what is going to be done, accountability

Finance doesn’t have to do much here. We just have to hold the people doing the action accountable to what was agreed.

And that is done by being ruthlessly clear on the questions – who, is doing what, by when

If you don’t know who is doing the action, then nobody does it

If you don’t know what’s being done then nothing gets done

And if you don’t put a timeline on it then it drifts.

Data comes from calculation, action comes from conversations and insights comes from both

What? So What? Now What?

And for a finance person this means understanding the “what (and why)?” deeply, asking questions to explore the “so what?”, and holding others accountable to the “now what?”.

We call the above process the Insights Clockface and we teach all of our teams the journey around that clockface in our workshops using live examples from your own data.

Get it right and you will see finance’s impact lift almost immediately

Get it wrong…. and the robots will replace you.