Everyone in finance is talking about AI.

And rightly so. It’s changing the world and finance has some key tasks it does that AI is perfect for.

Some are convinced it’s going to solve every problem.

Others think it’s the latest shiny object that will quietly fade away like blockchain dashboards or virtual reality meetings.

The truth is, like most things it will be somewhere in between.

AI has the potential to be transformational in finance.

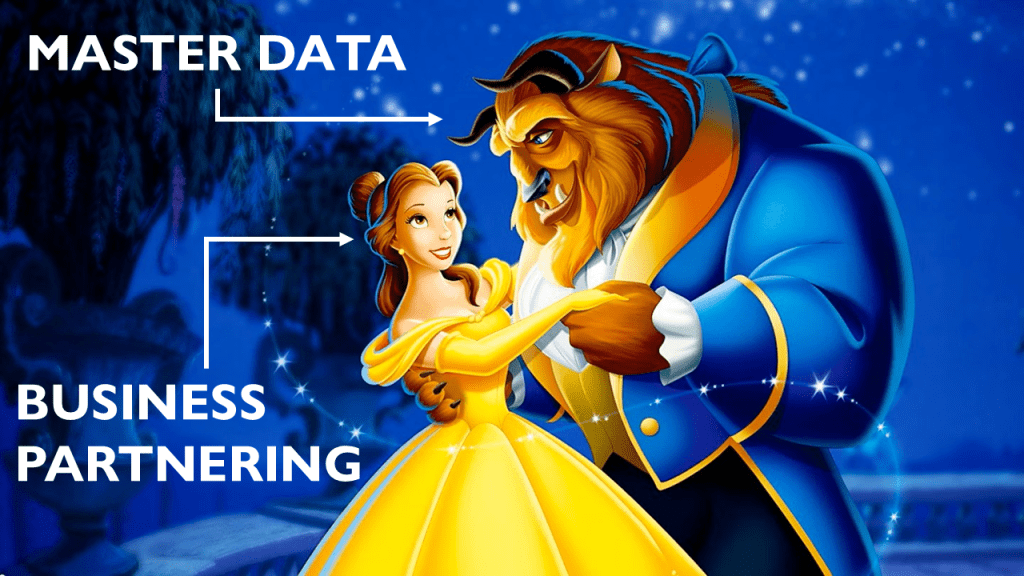

But there are two things that need addressing first. The first is – if your master data is wrong, AI is useless. Garbage in, garbage out. Only faster and slicker.

The second if you want commercial commentary and insight, then your finance teams will need to do it not AI

The more businesses I work with, the more I see the number one reason finance teams struggle. They say systems and processes, the source of it is bad master data.

And here’s the kicker – even when your master data is technically correct, it doesn’t always capture the commercial reality of what’s happening in the business.

Which means AI, on its own, won’t get you to where you need to be as a finance business partner.

Master data is the foundation of your finance systems. Customers, products, geographies, hierarchies, nodes, cost centres – the things every report and analysis hangs off.

For AI to work it simply has to be clean

If these aren’t clean, aligned, and maintained, your numbers lose credibility. And it doesn’t take much for it to go wrong. Have a new staff member forget to tick a couple of boxes or put a decimal place in the wrong spot and all hell breaks loose.

What we want to leverage AI for here is to identify where there is some master data gaps and holes that could impact the output.

Its effectively exception reports or validations on steroids.

But if master data is such an issue and exception reports and validations have been around since the last supper – then how will AI fix this?

It won’t.

Its not AI that will fix it, it’s the standards of your finance team and their motivations to do that monotonous stuff that makes the system hum.

AI doesn’t fix that. If left it just builds bad insight on top of bad data.

There’s a brilliant story Matt Bevan tells in his “Iran’s global network of goons” podcast. An Iranian bad guy wanted to torch a Jewish bakery in Bondi on Curlewis St. He hired two goons, gave them the address, and they typed it into Google Maps. Only problem: they got the wrong address. They didn’t set fire to the bakery. They torched Curly Lewis Brewery instead. Garbage in garbage out

Secondly is the commentary we can now get AI to do for us. Brilliant in theory.

Think about the commentary you want finance to provide. Commercial, insightful, forward-looking.

Data will tell you sales are up because of customer X, or product Y, or geography B. That’s true – but that’s transactional.

Commercial commentary is different.

It digs into what’s actually driving behaviour on the ground. The what, the why, the so what and the now what.

Sales are up not just because of geography B, but because a competitor pulled out of that market. Sales aren’t down because of customer X, but because their supply chain collapsed and they couldn’t order from you. Not just because of product Y, but because a new promotion coincided with an unseasonal spike in demand.

And here is what we are doing about it.

That’s context.

That’s commercial commentary.

And you don’t find context sitting behind a desk staring at dashboards. You find it by talking to sales, marketing, operations, and customers. By understanding what’s really happening and linking it back to the numbers.

AI can process the data. It can even summarise the commentary. But it can’t have the conversations that make sense of it all.

It’s why finance leaders who think “AI will do partnering for us” are in for a rude shock.

AI will be brilliant at reporting. It’ll be fine at transactional commentary. But it won’t bridge the gap between numbers and real-world commercial drivers. That’s the job of your people.

So what should CFOs do?

Start by being brutally honest about the state of your master data. Don’t just assume IT has it covered. Finance needs to own it, because finance lives and dies by it. If you wouldn’t make a manual forecast using your current master data, why on earth would you let AI automate it?

Then recognise that no matter how good your data is, it will never tell you the full story. The numbers are the starting point. The conversations are what bring them to life.

AI won’t ever replace finance teams who know how to step out from behind the spreadsheet, ask the right questions, and translate context into commercial insight.

The opportunity for finance is huge. Use AI to take away the grunt work. Let it automate the data gathering, the formatting, the transactional commentary. But don’t fall for the idea it can do the partnering for you. That’s still a human job.

In the end, AI will only ever be as good as the data you feed it – and the people who bring that data to life.

Put another way…..once the robots arrive the only thing left will be business partnering