In every finance team I’ve ever worked with, there’s one topic that consistently gets overlooked because it doesn’t feel exciting, strategic, or commercial.

Yet it’s the thing that quietly determines whether your team spends its time adding value… or adding frustration

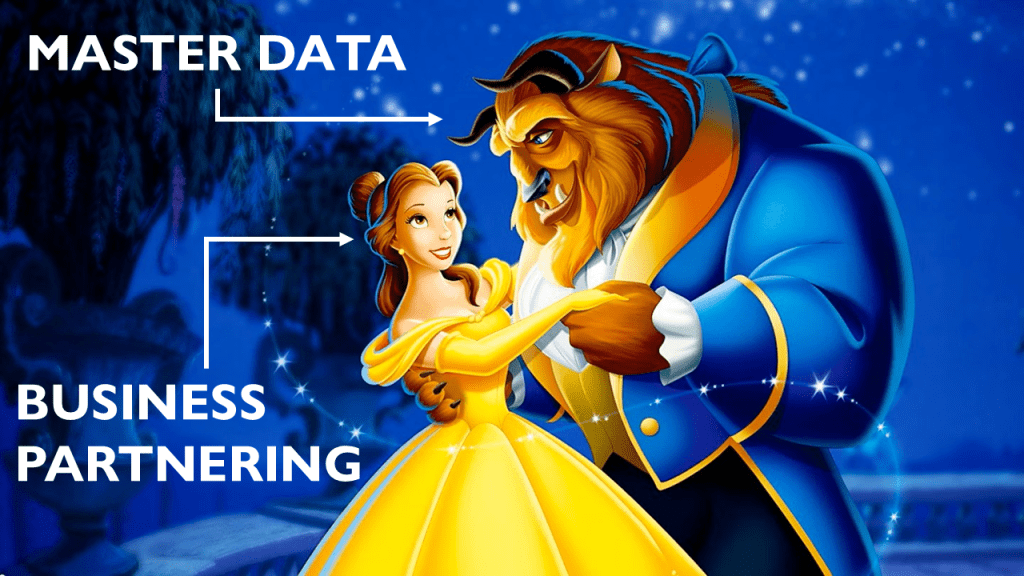

That topic is Master Data.

Not dashboards. Not AI. Not analytics. Not business partnering. Master data.

And if you’ve ever wondered why your team is stuck hunting errors, fixing reconciliations, or reconciling three versions of the same number, I can almost guarantee the root cause lives somewhere in your master data.

And the problem is most CFOs and senior finance leaders assume this foundation “just works.”

Everyone in the business assumes it. IT assumes it.

And many finance professionals would honestly prefer to assume it – because the alternative means going back into the plumbing of the organisation.

But the uncomfortable facts are if the foundations aren’t right, nothing built on them is stable.

When the master data is slow, confusing, duplicated, inconsistent, or owned by no one, the entire finance function becomes slow, confusing, duplicated, inconsistent, and owned by no one.

Everything downstream gets weighed down. Rework becomes the norm.

And the people who feel it first are the finance business partners.

You’re expected to produce insight quickly.

You’re expected to understand the business.

You’re expected to help leaders make commercial decisions.

But you can’t do any of that if you spend half your day reconciling, cleaning, validating, chasing, and redoing work because the core data structures are wrong.

It feels like you’re ready to run a marathon but someone’s tied a sandbag to your ankle.

And then the business wonders why finance can’t move faster.

In my book Compliance to Commercial I depict finance work through a simple image – a seesaw.

On one side sits all the work required to generate quality information. On the other sits all the value-adding work: the commercial insight, the forecasting, the influencing, the decision support.

You can’t sit on both sides at once.

If you’re spending time fixing processes, resolving errors, and validating data, you’re not spending time partnering, analysing, and influencing.

And the biggest single lever that determines which side of that seesaw you end up on is master data.

When master data is poor, finance slides left – into rework, reconciliation, and questions about accuracy.

When master data is strong, finance moves right – into insights, analysis, credibility, speed, and genuine partnership.

And AI works for you

It really is that simple.

Yet for many organisations, master data is “everyone’s job”. Which sounds sensible but actually guarantees it becomes no one’s priority. Responsibility gets diluted. Decisions get slow. Quality gets inconsistent. And the important but “unsexy” work quietly drops down the list.

This is why I firmly believe master data needs clear ownership. One accountable person. Not a committee. Not a rotating roster. Not “the system owner,” “the business owner,” and “the report owner” (all different people with different incentives).

One person.

Because when one person owns it, everyone knows who to go to, who decides, who maintains standards, and who ensures the rules are followed. Complexity reduces. Accountability strengthens. Quality improves.

And most importantly, speed increases.

Speed of reporting.

Speed of insight.

Speed of decision-making.

This is where master data shifts from being a hygiene factor to being a strategic enabler. How boring you say, I know. It is boring. But so are the best businesses in the world just doing the same thing over and over again for a very long time making loads of cash.

Clean, stable, well-governed master data is what allows a finance team to operate at tempo. It removes the drag. It takes weight off the seesaw. It frees up hours and days of effort that can be redirected to something the business actually values.

I’ve seen this play out hundreds of times. A team struggling to produce month-end numbers because their product hierarchies haven’t been mapped properly. Or a price change was put in incorrectly and now customers are bombarding the team with pricing claims that require everyone to stop and do more work. Or their cost centre structure changed last year but half the business is still using the old codes. Or just coding stuff to general expenses because they figure the pixies in finance will magically appear and put it in the right spot.

There are no pixies.

None of these issues are glamorous.

None of them win awards.

None of them get a CFO excited at first glance.

But solving them can transform a finance team’s effectiveness almost overnight.

The moment your master data becomes trustworthy, you notice something remarkable: the noise reduces.

Fewer ad hoc “quick questions.”

Fewer follow-up queries.

Fewer mysteries to solve.

Fewer debates about the numbers.

When no one questions the data, you can get on with the job.

And from my experience this is getting worse. Why? Because AI is bringing it to the surface.

In our workshops we ask teams how much time do you spend on data, how much on insight and how much on action.

Data is classified as cleaning data, producing reports and writing commentaries.

18 months ago that number sat somewhere around the 40-50% as an average for a finance team.

The last 6-12 months it is regularly sitting between 60-65%

How is this possible in a world of AI that’s supposed to make it go the other way.

Two words – Master Data.

Actually four words – Poor Master Data Discipline

Master data isn’t just about technical accuracy. It’s about creating an environment where finance professionals can do the work they joined the profession to do – the work the business actually needs.

If you want your finance team focusing on strategic insight rather than operational noise, fix your master data first.

If you want faster month-end, fewer surprises, and fewer questions about accuracy, fix your master data first.

If you want your finance business partners spending more time influencing commercial decisions and less time reconciling things that shouldn’t need reconciling, fix your master data first.

And if you want AI to dazzle you not hold you back, fix your master data first.

It’s not glamorous.

But it is foundational.

And foundations determine everything built on top.

Get this right, and the seesaw naturally tips toward value creation.

Get it wrong, and the seesaw anchors you in the place no CFO wants their team stuck.

Master data won’t win hearts and minds. It’s the ugly cousin of finance. But it will free your team to do the work that will.

And once you unlock that shift, the commercial impact is enormous.