Most finance professionals think marketing is manipulation, fluff, or something best left to people with bright slides and questionable metrics.

Which is ironic – because most finance professionals have no training in marketing and are some of the worst marketers there is. Not because they can’t sell, but because they fundamentally misunderstand how marketing actually works.

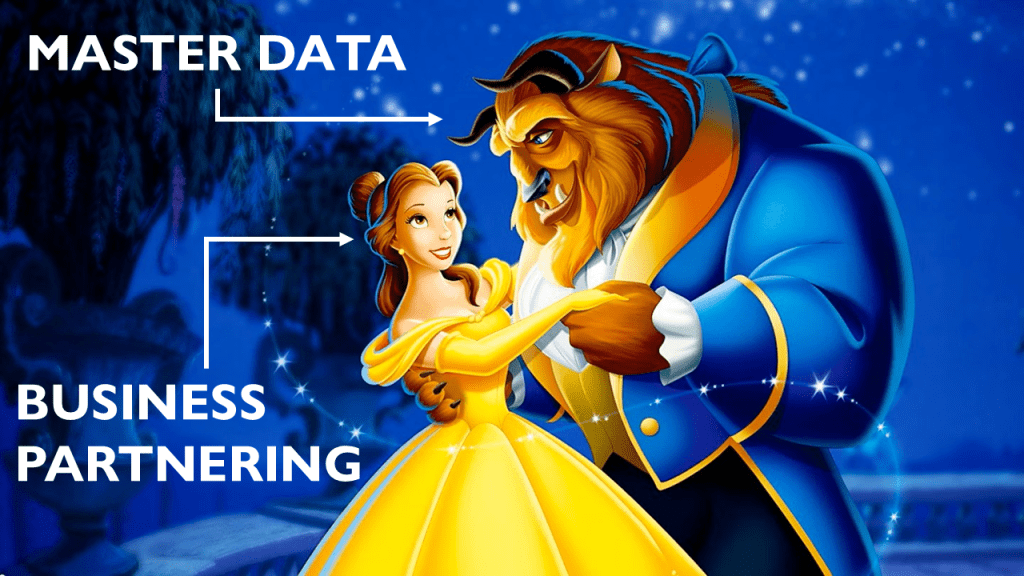

One of the core fundamental principles of marketing I’ve come across comes from Byron Sharp’s book How Brands Grow. And if there’s one concept that’s particularly relevant for anyone trying to build influence (or their brand) inside an organisation: Double Jeopardy.

Big brands don’t dominate because they have armies of fiercely loyal customers.

They dominate because they have far more light and occasional users than everyone else. They are bought a little bit by a lot of people, while smaller brands suffer twice – fewer buyers, and slightly less loyalty from those buyers as well.

The uncomfortable takeaway is that growth doesn’t primarily come from devotion. It comes from mental availability first then physical availability second. From being easy to think of in the moment that matters, not from being deeply loved by a small group, and then being accessible.

This is where the parallel with finance becomes uncomfortable.

Most finance professionals are trying to build loyalty when they should be building availability. They pour enormous effort into doing exceptional work for the same two or three stakeholders, pride themselves on being indispensable to “their” GM, and mistake depth of relationship for breadth of relevance across the organisation.

Or worse, try to impress the higher ups in finance only.

Then they wonder why no one else seeks them out.

Why they’re overlooked for broader roles, or why their influence seems to plateau. In marketing terms, they’ve become a niche brand with a tiny customer base, hoping loyalty will somehow compensate for lack of reach.

It won’t.

Inside organisations, influence doesn’t start with credibility. It starts with being known. You can dislike that idea, but reality doesn’t negotiate. People don’t ask for your input if they don’t think of you, and they don’t associate you with commercial thinking if they’ve never mentally linked you to it in the first place.

Mental availability always comes before influence.

This is where finance tends to push back. We tell ourselves that we shouldn’t have to promote ourselves, that good work will speak for itself, or that we don’t want to be political. All of that sounds noble, and none of it changes how humans actually behave at work.

Marketing doesn’t mean bragging or self-promotion.

It means making it easier for people to recall you when a decision is forming. Big brands don’t constantly shout about their quality; they simply show up, consistently and repeatedly, across many touchpoints.

Finance professionals, by contrast, tend to stay quiet, keep their heads down, wait to be invited, and assume decision-makers will objectively assess capability at exactly the moment it’s required.

That’s not how organisations work.

If you apply the idea of double jeopardy internally, the implication is simple but confronting. Stop trying to be indispensable to one stakeholder, and start being useful to many, even if that usefulness is light and imperfect at first.

That might mean offering a short commercial perspective in meetings that aren’t technically “yours,” contributing a one-page insight that travels beyond your immediate circle, asking sharper questions in forums where finance usually stays silent, or being present where decisions are being shaped rather than merely approved.

You’re not trying to dominate the room. You’re trying to register.

Mental availability is built through repetition, not heroics.

Most finance professionals dramatically overestimate how visible they already are. You might think a piece of analysis landed well, but for most people it barely registered, not because it wasn’t good, but because attention is scarce and memory is fragile.

Big brands don’t rely on one great campaign every few years. They rely on boring consistency. Doing the same thing over and over again for a very long time. And so should you.

But isn’t visibility without delivery dangerous?

Sure, if you show up and add no value, your internal brand will erode quickly. But the far more common problem in finance is the opposite: people with enormous capability whose work never gets pulled into the broader organisation because no one thinks of them.

Delivery without availability is invisible excellence, and invisible excellence doesn’t scale.

Marketing yourself internally doesn’t mean lowering standards. It means allowing more people to experience your thinking more often, without requiring a 40-slide deck every time.

Many finance professionals only “market” themselves through formal outputs like budgets, forecasts, and board packs, which is like a brand only advertising once the customer is already in the store.

Mental availability is built long before the buying moment – before the project, the crisis, or the restructure. The finance professionals who progress fastest aren’t necessarily the smartest in the room. They’re the ones who are easiest to think of when commercial input is needed.

That isn’t politics. It’s marketing.

Big brands don’t grow by converting non-users into loyalists overnight. They grow by being considered. Finance professionals don’t gain influence by convincing everyone they’re brilliant; they gain influence by being considered early, often, and naturally.

So if you’re serious about your internal brand, ask yourself a simple question. How many people across the organisation would genuinely think of you if a commercial decision was being shaped tomorrow?

Not respect you. Not like you. Just think of you.

If the number is small, that’s not a failure of character or competence. It’s a marketing problem. And marketing problems aren’t solved by working harder in the shadows. They’re solved by showing up more often, in more places, with clarity and intent.

Mental availability first. Physical availability and delivery second.

That’s how brands grow. And whether you like it or not, inside your organisation, that’s how your brand grows too.